Incoterms ®

Intra EU trade tends to fall in to two categories:

Ex Works (EXW) or Delivered Duty Paid (DDP).

These terms were fine when Customs processes were not required, but Brexit brings complication and you might want to re-examine your terms. EXW or DDP may not be the best fit as they are, essentially, domestic supplies. Using EXW or DDP may mean that you need to register for VAT in the foreign country.

INCOTERMS

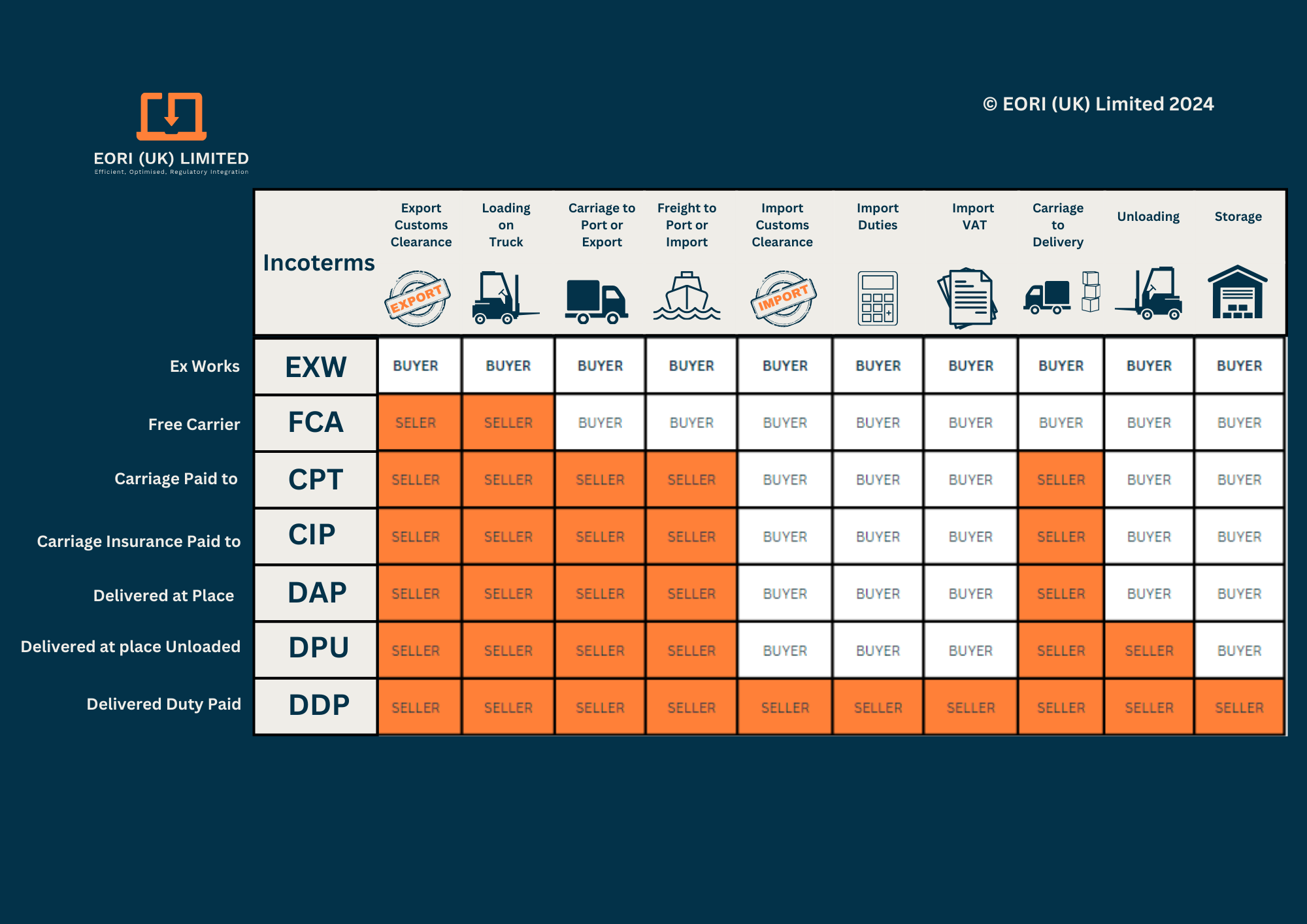

A key part for a UK trader is fully understanding International Commercial Terms (INCOTERMS). These clearly define which party is responsible for which part of the movement and quite importantly, where the risks and liabilities transfer.

EXW - Ex Works

Buyer is responsible for collecting and exporting the goods. Be careful! When UK was part of EU, VAT was handled on a reverse charge basis. Seller simply quoted buyers VAT number and the VAT was not charged at export sale but accounted for at import purchase. Liability was with the buyer. Seller needed only to validate the buyer's VAT number. Not so with Brexit....

Exports are ZERO RATED for VAT. An export declaration is required which is the mechanism used to prove that the goods have left the Customs territory. In order not to become liable for VAT and in order to prove that the goods have indeed left the Customs territory, you might want to retain control of the export declaration. The alternative is to rely on your buyer to discharge your liability.

You might want to consider FCA as a better incoterm.

DDP - Delivered Duty Paid

VAT : Be clear whether or not this includes VAT at destination. If your buyer insists that it does you may need to register for VAT in the destination country. This could involve the use of a VAT agent or fiscal representative.

DUTY : A common scenario is that the buyer will not pay the duty (if any). DAP becomes DDP. Duty may be less than you thought. Say, for example you sell something worth £1000 DDP and the duty is now 10%. This will cost you £100 in duty, right? Wrong!

DDP includes non-dutiable freight costs and the duty itself. In this example we first take off the freight after importation, call it £100. We then take off the duty at 10%. Leaving you a value for duty of £818.18. Apply the duty and you have £81.82 duty to pay. Roughly 1.8% less than you may have thought.

These are just a couple of reasons why we think DDP is problematic. Avoid if possible, or speak to us about a 'work around' solution.

Trusted By

CABIE Benefits

Save time & Stress

Just nine clicks and the shipment is released from the port! Faster at the frontier, less paperwork and less cost.

24hr Customs Expert Support

Fully supported 24/7 by our experienced Customs Specialist support team to ensure that things run smoothly.

Minimal Effort & Cost

Ship as frequently as you like without incurring full customs declaration charges each time.

You're In Good Company

.png?width=150&height=150&name=EORI%20LOGO%202025%20(6).png)