Fiscal representation

Exporting on DDP terms?

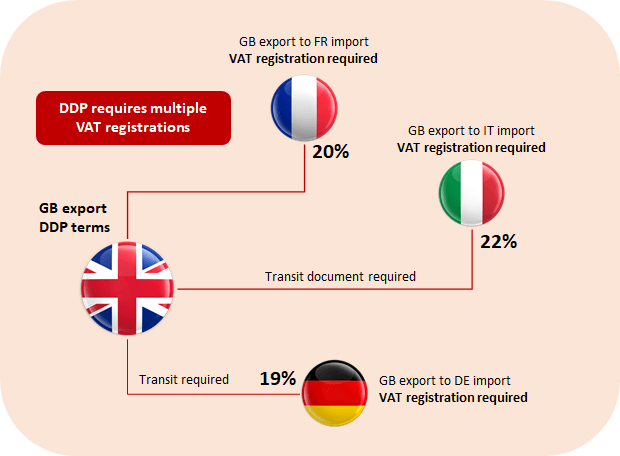

GB exports are often handled on a DDP (delivered duty paid) basis, but what does that mean in practical terms?

It means that the GB exporter is responsible for the documentation, duty and taxes at destination. It means that you (as a GB exporter) may need VAT registration in every EU country that you supply. You will need:-

01

VAT registration in each destination country

02

An EU EORI number linked to these VAT registrations

03

A fiscal representative or legal entity in each country

04

A customs agent prepared to work on an indirect basis

05

Transit documents for exports beyond the country of arrival

Are you ready for these challenges? (most are not!)

There is a better way. Let's get FISCAL!

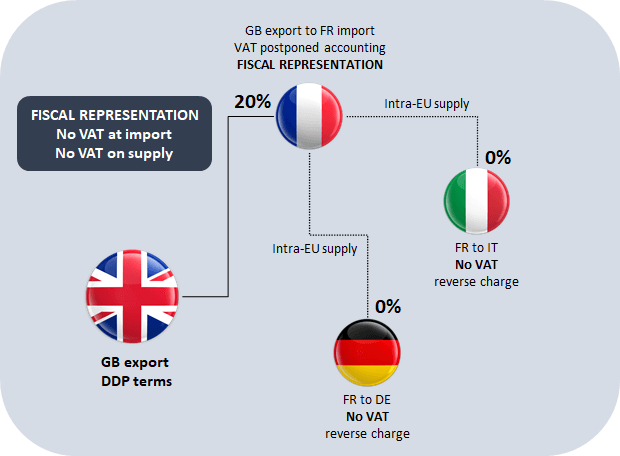

Having a fiscal representative in France (for example) means you can offer DDP with minimal hassle. How might that look?

- Good are shipped to France and cleared en-route

- No need for transit documents

- VAT is accounted for in France (no need to pay at importation)

- Onward supply to EU is nil VAT reverse charge (as pre EU exit)

- France is also nil VAT using domestic reverse charge

Too easy? It is! You just need a good partner. One you can trust to act on your behalf and manage your international VAT affairs.

We have teamed up with one of the best in the business and can...

- Manage your EU VAT/EORI application and registration

- Represent you in front of the tax authorities

- Manage your import VAT and filings obligations for DDP

- Offer guidance on postponed VAT accounting

- Manage your monthly/quarterly returns

- Provide a single point-of-contact

- Provide a self-help online portal unique to you

We can offer full registration or regime 42 fiscal representation

Apply now!

Please answer all questions as accurately as possible.

Trusted By

You're In Good Company

“No problems whatsoever, EORI (UK) easily the most hands-off customs procedure I have to endure !!!”

Rob Platt, Purchasing Manager, Infusion Group

"Since we entrusted them with all our customs clearances, we have resolved nearly all of the issues we previously had with customs. Everyone is extremely courteous and professional, available 24/7 with practically immediate response times—even in the middle of the night."

Stefano Lattarulo, CEO, Fresh Ways

“We have been from day one completely satisfied with EORI (UK) on every level and have recommended you more than once - great, pricing very fair, and it makes our importing much easier. . You are a brilliant company to work with!”

Christian Gimbett, The Good Food Network

"Can't say enough good things about EORI (UK). Find staff friendly and helpful. They don't leave you hanging. Which, to me, is so important in customs. Top notch service."

Neil Madden, Nomadic

“I am very happy with the support from EORI UK to our business. Not only with the day to day transactions but also regarding the level of support and expertise with new challenges facing us at present from Windsor and T.O.M.”

Shayne Leatham, Logistics Manager, Pilgrims Food Masters

“The overall concept of what EORI (UK) are trying to achieve in the Customs world and so far are successfully doing is fantastic! I would recommend their services to anyone considering EORI (UK), you won’t regret it!”

Joe Jeffery, Director, Zelir Logistics Ltd

.png?width=150&height=150&name=EORI%20LOGO%202025%20(6).png)